Business Central Comprehensive Payroll

A comprehensive payroll solution for Business Central that automates employee compensation, deductions, and tax calculations, ensuring accuracy and compliance.

A comprehensive payroll solution for Business Central that automates employee compensation, deductions, and tax calculations, ensuring accuracy and compliance.

Demo

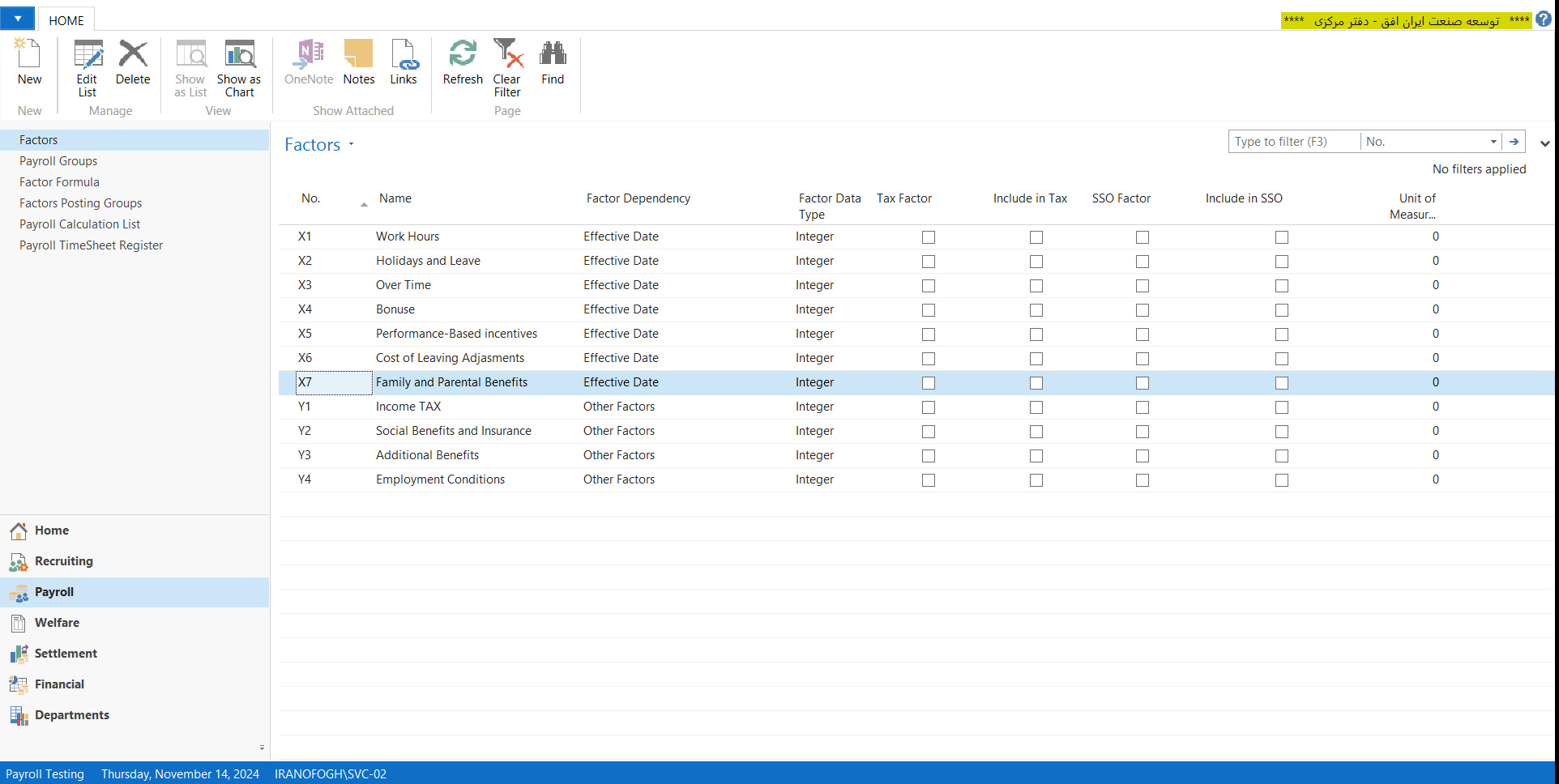

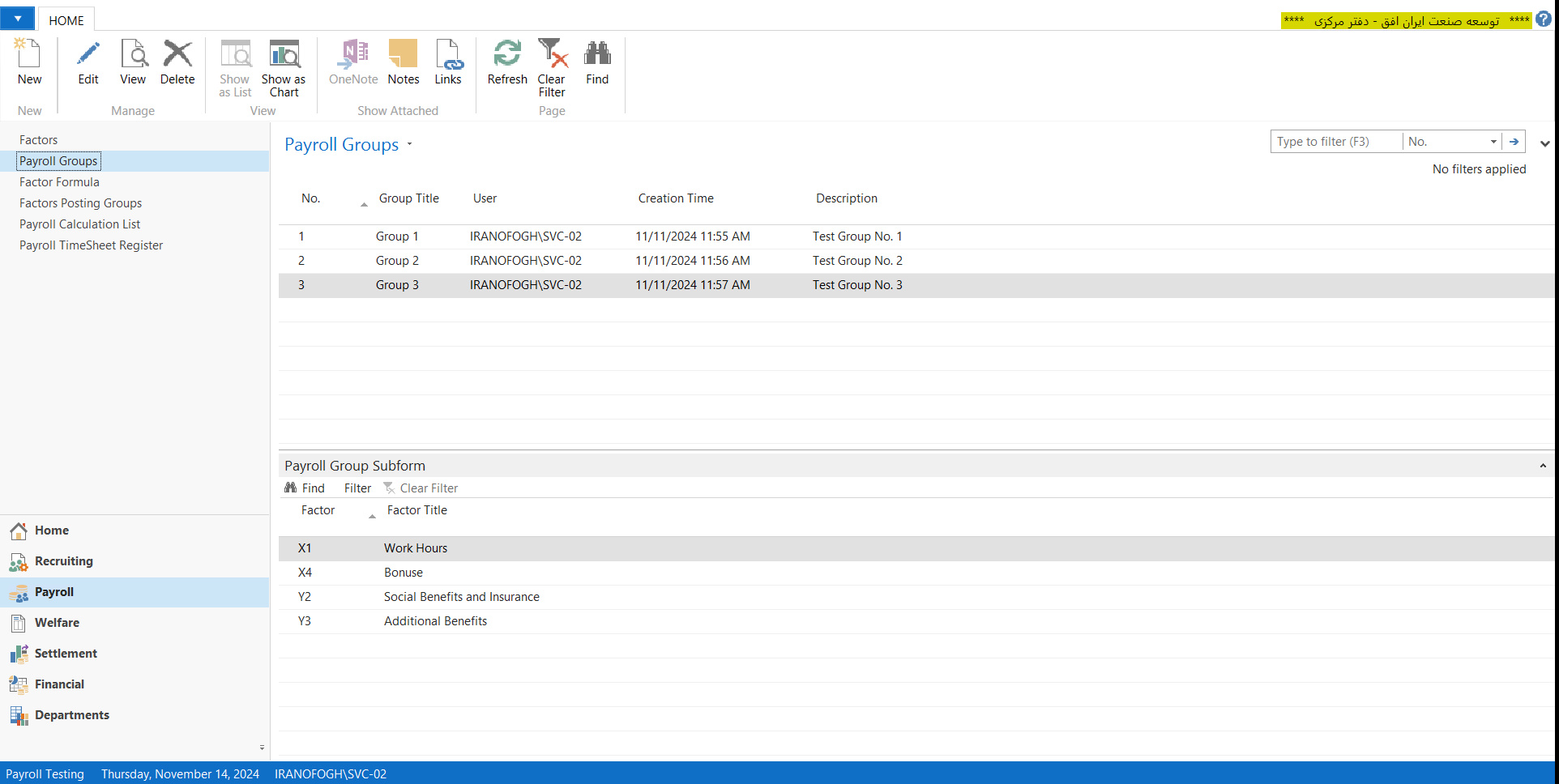

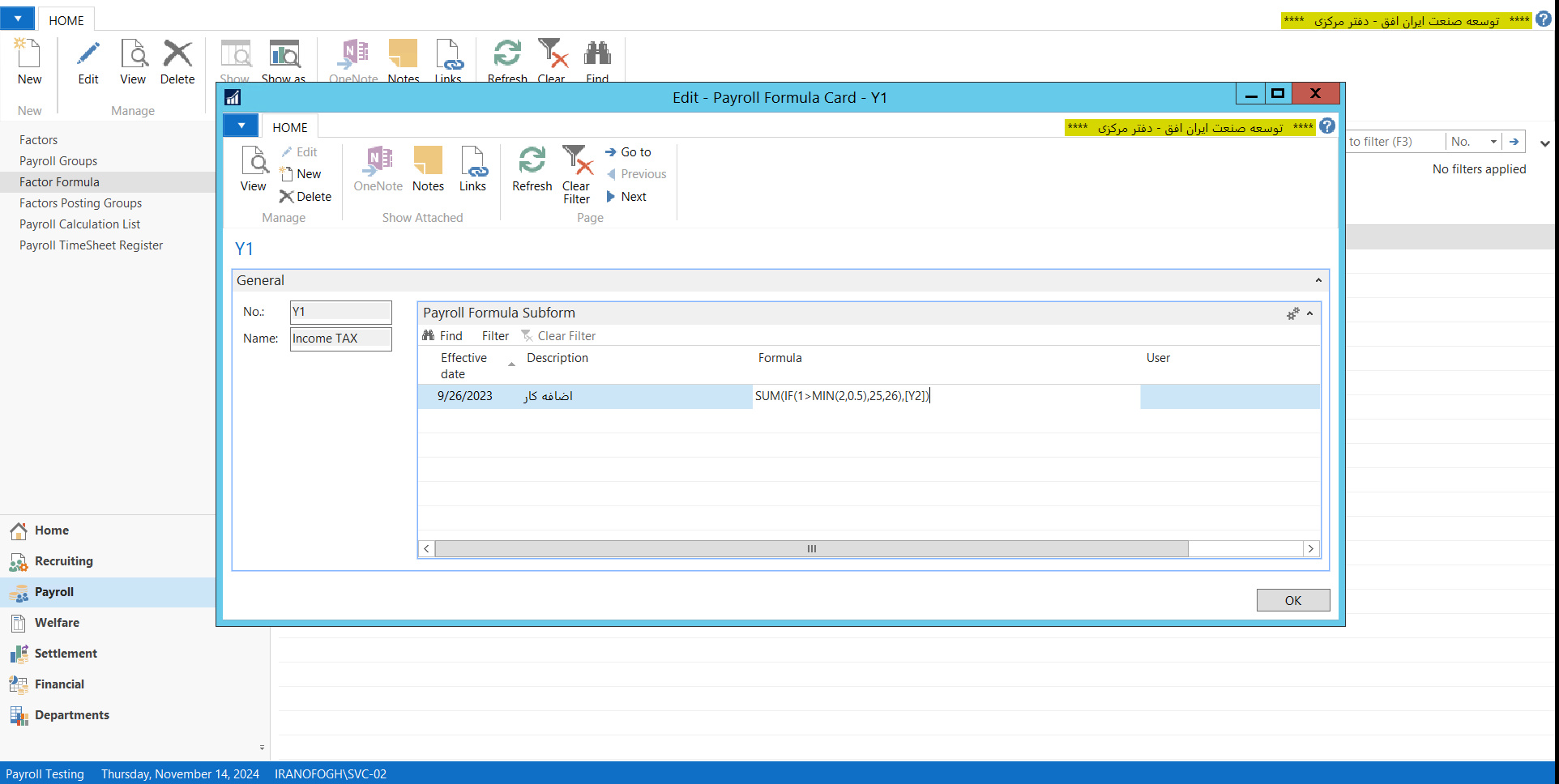

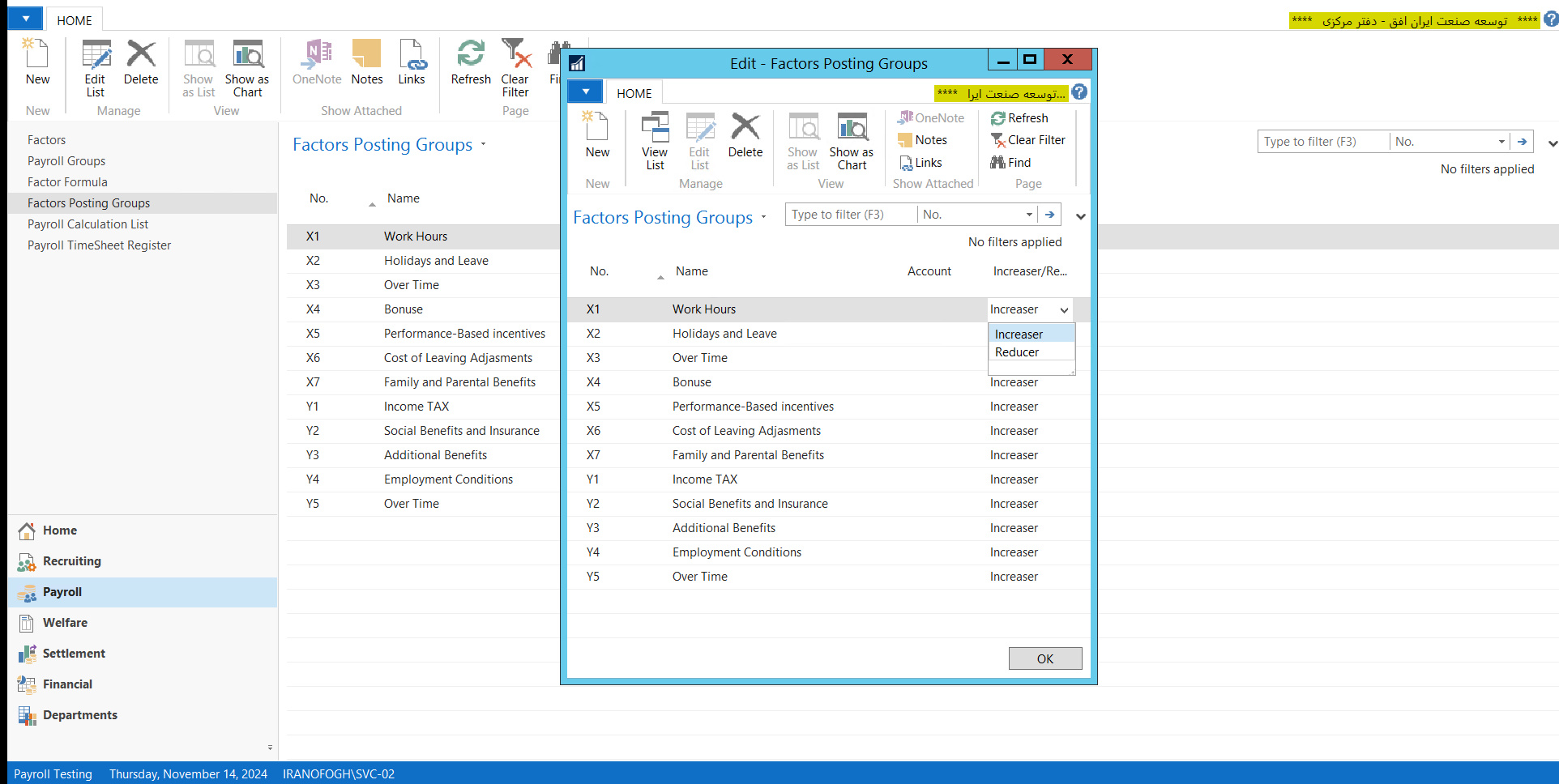

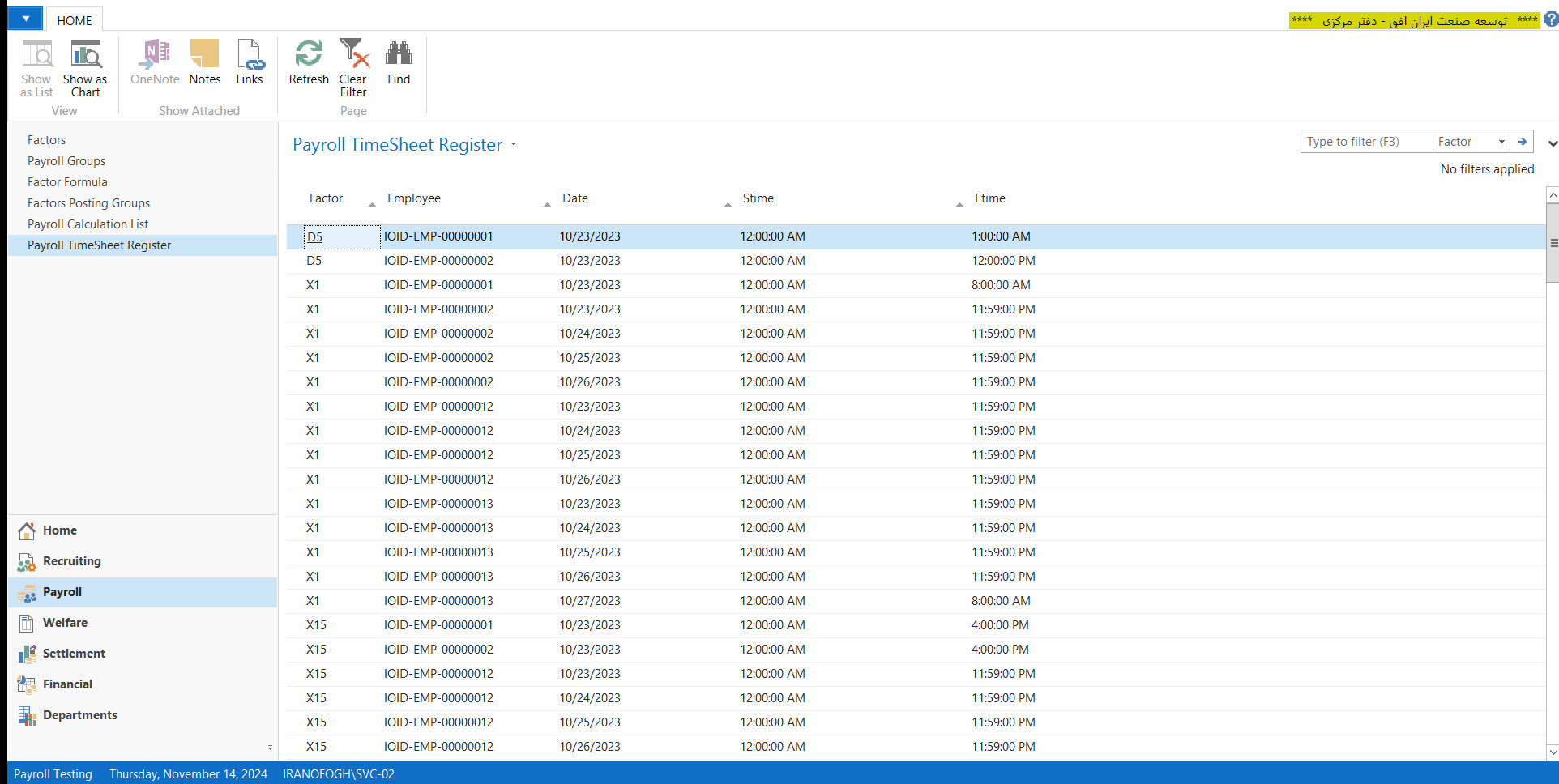

The Payroll add-on for Business Central simplifies and streamlines the payroll process, allowing businesses to manage employee compensation, deductions, and benefits directly within the ERP system. This tool automates the calculation of wages, taxes, and deductions based on customizable rules and employee data, ensuring accurate and timely payroll processing. With an intuitive interface, users can easily configure pay rates, bonus structures, overtime rules, and benefits, while the system automatically handles the complex calculations behind the scenes. This automation significantly reduces the time spent on manual payroll tasks and minimizes the risk of errors, ensuring compliance and accuracy in every payroll cycle.

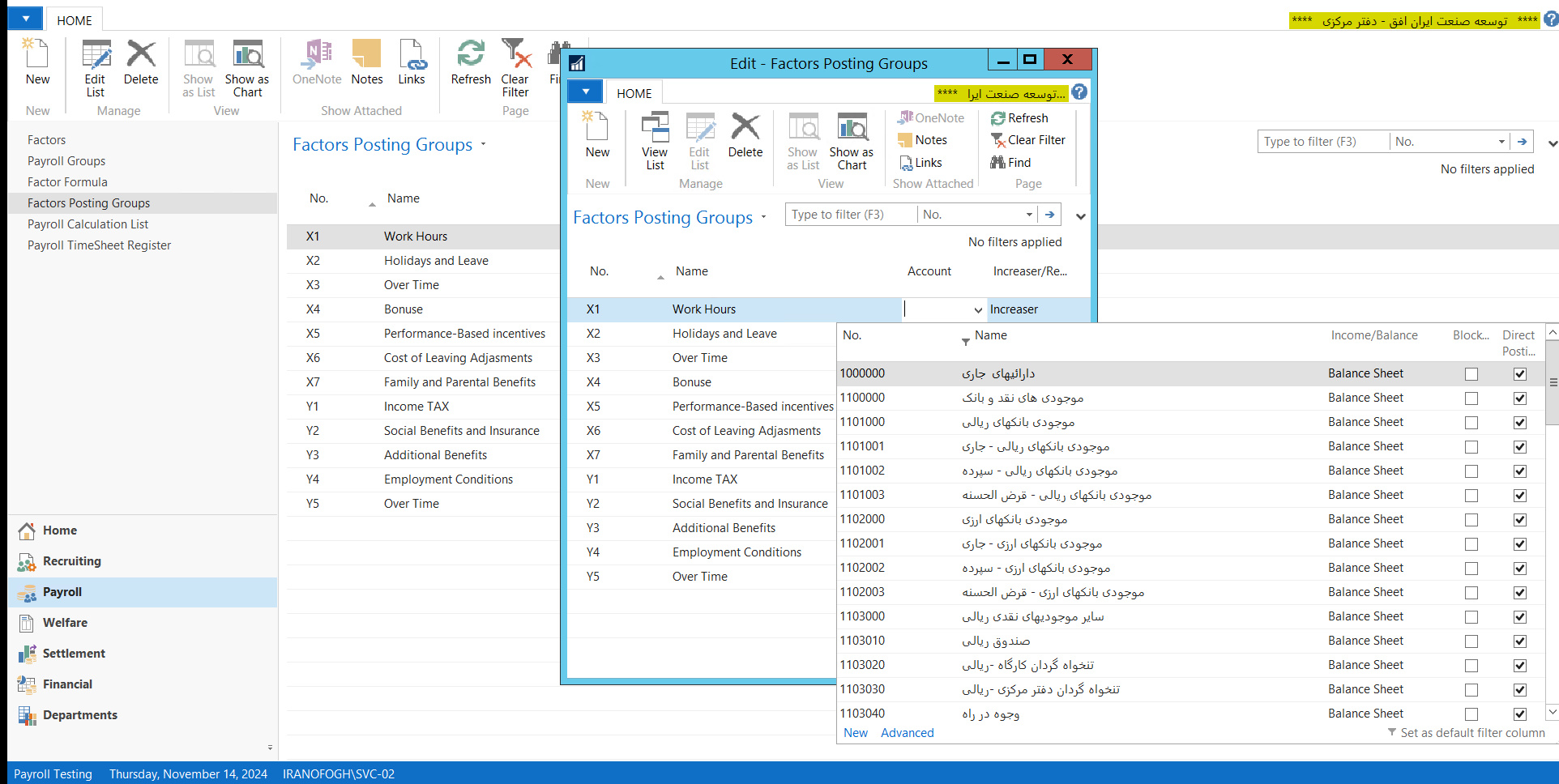

The Payroll add-on integrates seamlessly with Business Central, enabling real-time synchronization of employee data, including timesheets, leave balances, and benefits information. This integration ensures that all payroll-related data is consistently up-to-date, allowing HR and accounting teams to work with the most accurate and relevant information. By linking payroll directly to the ERP system, businesses can streamline their financial reporting, track labor costs more effectively, and gain valuable insights into payroll expenses without needing to rely on separate systems or manual data entry.

With advanced reporting and analytics features, the Payroll add-on provides detailed, customizable reports that help businesses gain visibility into payroll expenditures, tax liabilities, and compliance status. Managers can easily access insights on payroll costs by department, employee, or pay period, empowering them to make data-driven decisions. The tool also supports compliance with local tax regulations, ensuring that businesses stay on top of changing requirements and avoid costly penalties. Automated tax filings and deductions further reduce administrative overhead, saving time and ensuring accurate reporting.

Designed with scalability in mind, the Payroll add-on is suitable for businesses of all sizes, from small startups to large enterprises. Its flexibility allows for customization to meet specific business needs, whether handling a single payroll cycle or managing complex, multi-location payrolls. By integrating payroll directly into Business Central, this add-on offers a seamless, efficient solution for managing one of the most critical aspects of business operations—employee compensation—while reducing administrative burden and improving overall payroll accuracy.